Renting an apartment with no credit history can be a daunting task, but it’s not impossible. Many landlords and property management companies place a heavy emphasis on credit checks during the application process, making it challenging for those without an established credit history to secure housing.

However, with the right strategies and approach, you can increase your chances of finding a suitable rental without a credit report.

Why Is a Credit Check Required to Rent an Apartment?

Credit checks are a crucial part of the rental application process for landlords and property management companies. They use credit reports and scores to assess an applicant’s financial responsibility and risk of defaulting on rent payments.

A good credit score indicates a track record of making payments on time, while a poor score or no credit history raises red flags for potential landlords.

Landlords rely on credit checks because they want to minimize the risk of tenants failing to pay rent or damaging the property. A strong credit history provides reassurance that the tenant is likely to make rent payments on time and follow the terms of the lease agreement.

How to Build Credit for an Apartment?

If you’re starting from scratch with no credit history, building credit should be your first priority. Here are several strategies to help you establish and improve your credit profile:

Dispute Errors on Your Credit Report

Before taking any other steps, it’s essential to ensure that your credit report is accurate and free from errors. Incorrect information can significantly impact your credit score. Obtain copies of your credit reports from the three major credit bureaus (Experian, Equifax, and TransUnion) and dispute any errors or inaccuracies following the appropriate procedures.

Become an Authorized User

Consider asking a family member or trusted friend with a good credit history to add you as an authorized user on their credit card account. This can help you “piggyback” on their positive payment history, potentially boosting your credit score over time.

Make On-Time Payments

Payment history is the most significant factor influencing your credit score. Make sure to pay all your bills (e.g., utilities, cell phone, subscriptions) on time, every time. Setting up automatic payments or payment reminders can help you stay on track.

Set Goals

Establish specific credit-building goals and a timeline for achieving them. Monitor your credit score progress regularly and adjust your strategies as needed.

Apply for a Secured Credit Card

A secured credit card is an excellent option for building credit from scratch. You’ll need to provide a refundable security deposit, which will become your credit limit. Use the card responsibly by keeping your credit utilization low and making payments on time to establish a positive payment history.

Ways to Build Credit, Fast

If you need to establish credit quickly for an upcoming rental application, consider these strategies:

Check your credit

Before starting any credit-building efforts, it’s crucial to understand your current credit situation. Obtain copies of your credit reports from the three major credit bureaus (Experian, Equifax, and TransUnion) and review them for accuracy. Dispute any errors or inaccuracies that could be negatively impacting your scores.

Aim for a high credit score

While there’s no universal credit score requirement for renting, most landlords and property management companies prefer applicants with scores in the 600s or higher. The higher your score, the better your chances of getting approved.

Apply for a secured credit card

As mentioned earlier, a secured credit card is an excellent way to build credit from scratch. Use the card responsibly by keeping your credit utilization low (ideally below 30%) and making payments on time.

Consider a credit-building loan

A credit-builder loan is designed specifically for individuals with little or no credit history. The lender holds the loan amount in a secure account while you make monthly payments. After successfully repaying the loan, you’ll receive the funds, and the lender will report your positive payment history to the credit bureaus.

Get a car loan

If you’re in the market for a new or used vehicle, an auto loan can help establish credit history. However, be cautious about taking on more debt than you can comfortably afford.

Make payments towards your student loans

If you have outstanding student loan debt, making consistent, on-time payments can positively impact your credit score. Student loan payments are reported to the credit bureaus and contribute to your payment history.

Inquiring about Credit Checks

Before submitting a rental application, it’s essential to understand the landlord’s or property management company’s credit check policies. Here’s a sample inquiry message you can use:

Subject: Inquiry about Credit Check Policy

Dear [Landlord/Property Manager],

I hope this message finds you well. I am reaching out regarding my interest in renting the [Apartment/Unit Number] at [Property Address]. Before proceeding with my application, I would appreciate some clarification on your credit check policy.

Given my unique circumstances, I have a limited credit history due to [briefly explain your specific situation]. However, I am more than willing to provide evidence of my steady income, savings, and impeccable references. I am fully committed to upholding the responsibilities of a reliable and conscientious tenant.

Could you kindly outline your credit check requirements and inform me if there are alternative methods available for demonstrating my financial reliability?

Thank you very much for your time and consideration. I eagerly await your response.

Best regards,

[Your Name]

This inquiry demonstrates your awareness of the credit check process and willingness to provide alternative documentation to support your rental application.

How to get an apartment with little or no credit?

Even with limited or no credit history, there are still options available for securing a rental. Here are some strategies to consider:

Rent from an individual landlord, but beware of scams

Individual landlords may be more flexible with credit requirements compared to large property management companies. However, it’s crucial to exercise caution and watch out for rental scams. Always verify the legitimacy of the landlord and the property before providing any personal or financial information.

Offer to move in right away

Landlords often appreciate tenants who can move in quickly, as it minimizes vacancy periods and lost rental income. If you’re prepared to move in within a short timeframe, highlight this advantage in your application.

Prove income or savings balance

Without a credit history, demonstrating financial stability through proof of steady income or substantial savings can increase your appeal as a tenant. Provide recent pay stubs, bank statements, or other documentation to support your financial situation.

Pay a few months’ rent upfront as a security deposit

Offering to pay a larger security deposit upfront, such as several months worth of rent, can provide landlords with additional reassurance and offset the risk of renting to someone without credit history.

Provide reference letters

Character references and professional recommendations can go a long way in supporting your rental application. Ask former landlords, employers, or trusted individuals to provide letters attesting to your reliability, responsibility, and character.

Offer to start out month-to-month

Some landlords may be more willing to offer a month-to-month lease initially, rather than a long-term commitment. This option allows both parties to evaluate the tenant-landlord relationship before committing to a longer lease.

Get a co-signer or a roommate with strong credit

Having a co-signer or roommate with an established credit history can improve your chances of getting approved for a rental. The co-signer or roommate’s credit will be considered alongside yours during the application process.

Read More: Hole House APK: For Your Android Device

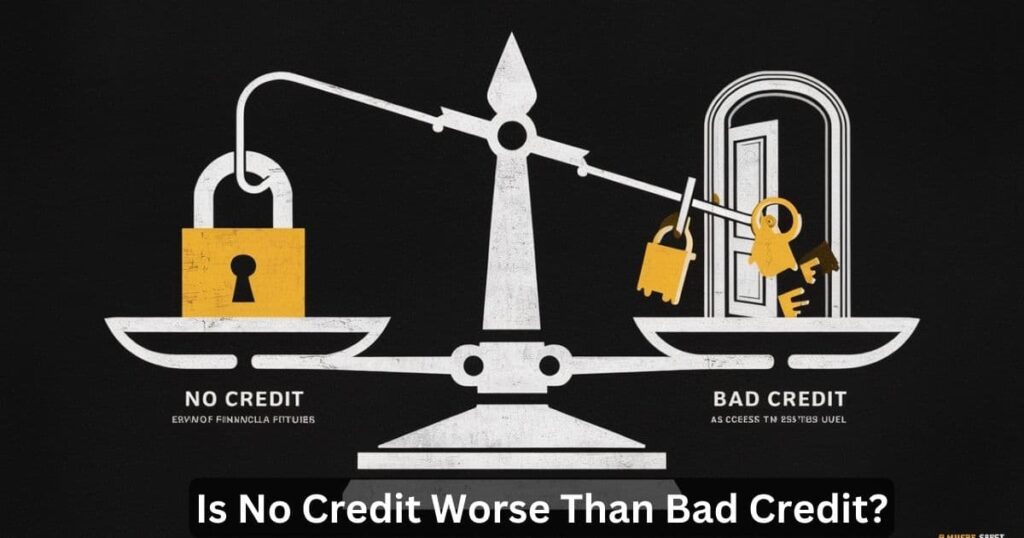

Is No Credit Worse Than Bad Credit?

While having no credit history presents challenges, it’s generally considered better than having a poor credit score or negative items on your credit report. Here’s how the two situations compare:

No Credit:

- Landlords may view a lack of credit history as a neutral factor, rather than a red flag.

- You have the opportunity to build credit from scratch through responsible financial habits.

- Providing additional documentation (e.g., proof of income, references) can help offset the lack of credit history.

Bad Credit:

- Negative items like late payments, collections, or judgments can make landlords hesitant to approve your application.

- Repairing bad credit takes time and consistent effort.

- You may need to pay higher security deposits or find a co-signer to offset the risk.

Regardless of your credit situation, being upfront and proactive can increase your chances of securing a rental. Here are some tips for renting with bad credit:

Bring references and proof of income

As with having no credit, providing strong references and documentation of steady income can help counterbalance a poor credit history.

Offer to pay a larger security deposit

A larger security deposit (e.g., two or three months’ rent) can provide landlords with additional financial protection and incentive to approve your application.

Explain Your Situation to the Landlord

Don’t shy away from discussing your credit challenges openly and honestly with potential landlords. Explain the circumstances that led to your poor credit and outline the steps you’re taking to improve your financial situation.

Get a Cosigner

Having a cosigner with good credit can significantly improve your chances of getting approved. However, make sure both parties understand the legal and financial responsibilities involved.

Renting No Credit Check Apartments

While many landlords and property management companies conduct credit checks as part of the application process, there are still options for finding rental opportunities that don’t require a credit check. Here are some strategies to consider:

Start Online

Begin your search online by using relevant keywords like “no credit check apartments” or “apartments for rent with no credit check.” Reputable rental listing websites like Apartments.com, Zillow, and Rent.com often have filters or search options to help you find no-credit-check rentals in your desired location.

Rent from Private Landlords

As mentioned earlier, individual landlords may be more flexible with credit requirements compared to larger property management companies. Search for “apartments for rent by owner” or utilize word-of-mouth recommendations to find private landlords in your area.

Find Month-to-Month Leases

Many landlords offering month-to-month leases may be more lenient with credit checks, as the shorter commitment reduces their risk. This option also allows you to build a positive rental history before transitioning to a long-term lease.

Offer to Move-in Early

Landlords appreciate tenants who can move in quickly, as it minimizes vacancy periods and lost rental income. Highlight your ability to move in within a short timeframe, which could offset concerns about your lack of credit history.

Provide Proof of Income & Savings

Without a credit history, demonstrating financial stability through proof of steady income or substantial savings can increase your appeal as a tenant. Provide recent pay stubs, bank statements, or other documentation to support your financial situation.

Find a Character Reference

Character references and professional recommendations can go a long way in supporting your rental application. Ask former landlords, employers, or trusted individuals to provide letters attesting to your reliability, responsibility, and character.

Offer a Higher Security Deposit

Offering to pay a larger security deposit upfront, such as several months’ worth of rent, can provide landlords with additional reassurance and offset the risk of renting to someone without credit history.

Find a Cosigner

Having a cosigner with an established credit history can improve your chances of getting approved for a rental, even without a credit check. The cosigner’s credit and income will be considered alongside yours during the application process.

Secure a Guarantor

Similar to a cosigner, a guarantor agrees to take financial responsibility for the rent if you fail to make payments. This additional layer of security can make landlords more comfortable renting to someone without credit history.

Showcase Your Assets

If you have valuable assets, such as a vehicle, investments, or property ownership, highlight these assets during the application process. They can demonstrate your financial stability and responsibility.

Live With a Roommate

Rooming with someone who has an established credit history can improve your chances of getting approved for a rental, even without a credit check. The roommate’s credit and income will be considered alongside yours during the application process.

Get Help Locating No Credit Check Apartments

If you’re struggling to find suitable no-credit-check rental options on your own, consider enlisting the help of a professional rental locator service or real estate agent. These services can leverage their expertise and connections to identify listings that align with your specific needs and credit situation.

Start monitoring your credit

While these strategies can help you secure a rental without an established credit history, it’s essential to start building and monitoring your credit as soon as possible. A solid credit profile will not only make future rental applications smoother but also open doors to other financial opportunities, such as obtaining loans, credit cards, and mortgages.

By following the credit-building tips outlined earlier, maintaining responsible financial habits, and regularly checking your credit reports for accuracy, you can gradually establish a strong credit history that will serve you well in the long run.

Remember, renting an apartment with no credit may require some extra effort and creativity, but it’s definitely achievable. Stay persistent, be prepared to provide alternative documentation, and don’t hesitate to communicate openly with potential landlords about your situation. With the right approach, you can find a suitable rental and start building your credit simultaneously.

Case Study: Renting with No Credit After College

Meeting Jessica, a recent college graduate embarking on her first apartment hunt without an established credit history. After learning about her options, she decided to take the following steps:

- Obtained a Secured Credit Card: Jessica applied for a secured credit card from her bank, providing a refundable deposit of $200 to establish her credit limit. She used the card responsibly for small purchases and paid her balance in full each month.

- Provided Proof of Income and Savings: Armed with her recent pay stubs from her first job and bank statements showing a healthy savings balance, Jessica demonstrated her financial stability to potential landlords.

- Leveraged Character References: Jessica requested reference letters from her former university advisor and a trusted family friend, highlighting her responsible nature and reliability as a tenant.

- Searched for Private Landlords: After several rejections from large property management companies, Jessica focused her search on private landlords advertising “no credit check” rentals.

- Offered a Larger Security Deposit: To seal the deal, Jessica proposed paying a security deposit equivalent to three months rent, providing the landlord with additional financial security.

After six months of diligent effort, Jessica secured her first apartment with a private landlord. She continued building her credit through responsible financial habits and eventually transitioned to a long-term lease with a property management company once her credit score improved.

Expert Advice: Landlord Perspective

To provide a balanced view, we spoke with Sarah, an experienced landlord who has rented to tenants with limited or no credit history. Here’s her advice:

“As a landlord, my primary concern is finding reliable, responsible tenants who will take care of the property and pay rent on time. While a strong credit history is preferred, I’m open to considering applicants without credit if they can demonstrate financial stability through steady income, savings, and solid references.”

Sarah emphasizes the importance of transparent communication from the start. “If an applicant is upfront about their credit situation and provides a reasonable explanation, I’m more likely to work with them to find a mutually agreeable arrangement.”

She also suggests offering a larger security deposit or finding a co-signer as potential solutions for tenants with no credit history.

“At the end of the day, it’s about mitigating risk,” Sarah explains. “If a tenant can prove their financial responsibility through alternative means, I’m willing to give them a chance, as long as they’re committed to being a great tenant.“

Quotes and Wisdom

Here are some insightful quotes from experts and successful renters on navigating the rental process with no credit:

“Building credit is like building a house – it takes time and patience, but the effort is worth it in the end.” – Dave Ramsey, Personal Finance Guru

“Don’t let a lack of credit history hold you back. Be proactive, be prepared, and be persistent – the right opportunity will come along.” – Tiffany Aliche, Financial Educator

“My advice to anyone renting with no credit is to be transparent and show landlords why you’re a great tenant through other means, like references and proof of income.” – Jake, a young professional who secured an apartment with no credit

Remember, while having an established credit history can make the rental process smoother, it’s not an insurmountable hurdle. With the right strategies, documentation, and perseverance, you can find a suitable rental opportunity and begin building your credit simultaneously.

Building Credit After Renting with No Credit

Once you’ve secured a rental without a credit history, it’s important to start building your credit right away. Here are some tips to help you establish a strong credit profile:

Become an Authorized User

Consider asking a family member or trusted friend with good credit to add you as an authorized user on one of their credit card accounts. This can help you “piggyback” on their positive payment history and start building credit without opening a new account.

Make Rent Payments on Time

Your rent payments can potentially be reported to the credit bureaus and contribute to your payment history, which is the most significant factor in your credit score. Set up automatic payments or reminders to ensure you never miss a due date.

Apply for a Secured Credit Card

If you haven’t already done so, applying for a secured credit card can be an excellent way to establish your own credit history. Use the card responsibly by keeping your credit utilization low and making payments on time.

Monitor Your Credit Reports

Once you start building credit, it’s crucial to monitor your credit reports regularly. Check for any errors or inaccuracies that could be impacting your scores and dispute them promptly. Many credit monitoring services offer free credit reports and scores, making it easy to stay on top of your credit.

Set Credit Goals

Establishing specific credit goals can help you stay motivated and focused on improving your credit scores. For example, you might aim to reach a credit score of 700 within a year or to have three active credit accounts in good standing.

By following these steps, you’ll be well on your way to establishing a strong credit history that will serve you well in the future, whether you’re renting, applying for loans, or making other major financial decisions.

Final Words

Renting an apartment with no credit history may seem daunting, but it’s a achievable goal with the right approach. By following the strategies outlined in this guide, such as providing proof of income and savings, obtaining character references, offering larger security deposits, and seeking out flexible landlords, you can increase your chances of securing a rental.

Remember, building credit should be a priority once you’ve found a place to live. With consistent efforts and responsible financial habits, you’ll establish a solid credit history that will open doors to future housing and financial opportunities. Stay persistent, be transparent, and don’t let a lack of credit hold you back from finding your dream rental.

Frequently Asked Questions

Here are some common questions and concerns about renting an apartment with no credit:

Do I have to pay a higher security deposit if I don’t have credit?

A: It’s possible that some landlords may require a larger security deposit to offset the perceived risk of renting to someone without an established credit history. However, this is not a universal requirement, and many landlords are open to alternative forms of documentation, such as proof of income and references.

Can I get an apartment with a cosigner if I have no credit?

A: Yes, having a cosigner with good credit can significantly improve your chances of getting approved for a rental, even if you don’t have a credit history. The cosigner’s credit and income will be considered alongside yours during the application process.

How long does it take to build credit from scratch?

A: Building credit from scratch can take several months to a year, depending on your specific circumstances and the credit-building strategies you employ. Consistently making on-time payments and maintaining a low credit utilization ratio are key factors in establishing a positive credit history.

Will I have to pay application fees if I don’t have credit?

A: Most landlords and property management companies charge application fees regardless of your credit situation. These fees cover the cost of running credit checks, background checks, and processing your application. While some landlords may waive these fees for applicants with no credit history, it’s best to be prepared to pay the standard application fees.

Can I rent an apartment with a deferred payment plan if I have no credit?

A: While some landlords may offer deferred payment plans or alternative payment arrangements, it’s generally less common for applicants with no credit history. Your best bet is to demonstrate financial stability through proof of income, savings, and responsible money management habits.